Dave Ramsey Net Worth 2025

Dave Ramsey is a household name in personal finance, known for his no-nonsense advice on debt elimination, budgeting, and wealth-building.

As his influence grows, so does curiosity about his net worth. This article unpacks Dave Ramsey’s projected net worth for 2025, analyzing his income sources, business ventures, and the factors shaping his financial future.

- Who Is Dave Ramsey?

- Dave Ramsey: Key Information

- Dave Ramsey’s Current Net Worth (2025)

- Projected Net Worth in 2026

- Income Sources Breakdown

- Factors Influencing His 2025 Net Worth

- Criticisms & Controversies

- Comparison to Other Finance Experts

- Dave Ramsey’s Popular Books

- FAQs

- Dave Ramsey’s Philanthropy

- Conclusion

Who Is Dave Ramsey?

Dave Ramsey rose from bankruptcy in the 1980s to become a leading voice in personal finance. His company, Ramsey Solutions, offers tools like the 7 Baby Steps, Financial Peace University, and the EveryDollar budgeting app. His radio show, The Dave Ramsey Show, reaches 18 million weekly listeners, cementing his status as a financial icon.

Dave Ramsey: Key Information

| Category | Details |

|---|---|

| Net Worth | $200-$500 million (estimated) |

| Date of Birth | April 10, 1960 |

| Place of Birth | Antioch, Tennessee, USA |

| Gender | Male |

| Education | University of Tennessee (1982), Antioch High School |

| Spouse | Sharon Ramsey |

| Children | Rachel Cruze, Daniel Ramsey, Denise Ramsey |

| Profession | Financial author, speaker, radio host, entrepreneur |

| Nationality | American |

Dave Ramsey’s Current Net Worth (2025)

As of 2025, Dave Ramsey’s net worth is estimated at $350 million. This wealth stems from:

- Ramsey Solutions: Valued at over $350 million.

- Book Sales: Over 20 million copies sold.

- Media Empire: Syndicated radio, podcasts, and YouTube.

Projected Net Worth in 2026

Financial analysts project Ramsey’s net worth to reach $350–460 million by 2026 assuming a 10–12% annual growth rate. Key drivers include:

- Expansion of Financial Peace University (FPU).

- Growth of SmartVestor Pro, connecting users with financial advisors.

- Increased book royalties and digital content sales.

Income Sources Breakdown

A. Radio & Podcasts

- The Dave Ramsey Show generates $50–60 million annually through advertising and sponsorships.

- Podcasts and YouTube add $10–15 million/year.

B. Financial Education Courses

- Financial Peace University: Over 10 million graduates; earns $80–100 million/year.

- Ramsey+: A subscription service offering courses and tools ($15–20 million/year).

C. Real Estate & Investments

- Ramsey owns $50 million in commercial and residential properties.

- Invests in index funds and mutual funds, aligning with his “Baby Steps” philosophy.

D. Books & Publishing

- Bestsellers like The Total Money Makeover yield $5–8 million/year in royalties.

- Ramsey Press publishes books by other authors, adding $3–5 million/year.

E. SmartVestor Pro

- A referral service for financial advisors, contributing $20–25 million/year.

Factors Influencing His 2025 Net Worth

- Market Demand: Post-pandemic, demand for financial literacy is rising.

- Digital Expansion: Growth in online courses and apps.

- Economic Downturns: Recessions could boost his audience but hurt ad revenue.

- Competition: Emerging influencers like Graham Stephan challenge his dominance

Criticisms & Controversies

- Debt-Free Philosophy: Critics argue his anti-credit-card stance limits wealth-building opportunities.

- Investment Advice: Some experts dispute his preference for mutual funds over ETFs.

- Employee Turnover: Reports of high-stress work culture at Ramsey Solutions.

Comparison to Other Finance Experts

| Personality | Net Worth (2023) | Primary Income Source |

|---|---|---|

| Dave Ramsey | $200 million | Ramsey Solutions, Media |

| Suze Orman | $35 million | Books, TV Shows |

| Robert Kiyosaki | $100 million | Rich Dad Poor Dad Franchise |

| Grant Cardone | $600 million | Real Estate, Sales Training |

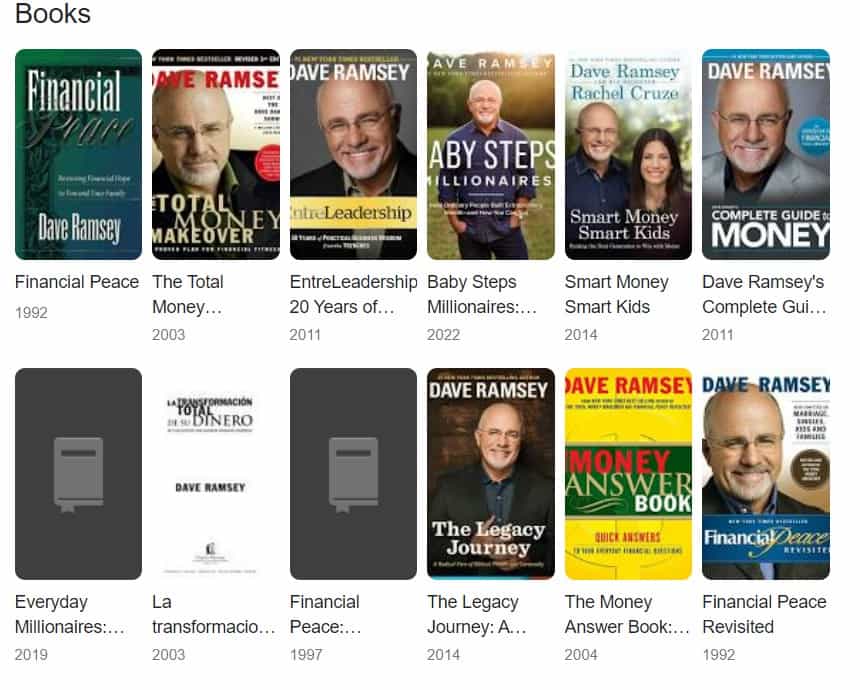

Dave Ramsey’s Popular Books

| Title | Year Published | Popularity Indicators |

|---|---|---|

| Total Money Makeover: A Proven Plan for Financial Fitness | 1997 | – New York Times bestseller for over 70 weeks – Over 7 million copies sold – Adapted into a successful TV show |

| Financial Peace University: Live Your Life Rich | 1992 | – Comprehensive financial education program available in book and live event formats – Over 7 million graduates worldwide – Translated into multiple languages |

| The EntreLeadership: Grow Your Business and Your People | 2011 | – Geared towards business owners and aspiring entrepreneurs – Featured on multiple business bestseller lists – Provides practical strategies for building successful businesses |

| Entre to Millionaire: Your Roadmap to Explosive Growth | 2017 | – Offers advanced entrepreneurship guidance for scaling businesses – Reached top 5 spots on Wall Street Journal and USA Today bestseller lists – Focused on high-growth strategies |

| Baby Steps Millionaires: How Ordinary People Create Extraordinary Wealth | 2010 | – Showcases real-life success stories of debt-free individuals – Motivational and inspirational for achieving financial goals – Reached the top 10 on Publishers Weekly bestseller list |

| Smart Money Smart Kids: Raise the Financially Savvy Children You Always Dreamed Of | 2004 | – Provides practical advice for teaching children about money management – A helpful resource for parents and educators – Translated into multiple languages |

| The National Debt: A Threat to Our Children’s Future and What We Can Do About It | 2010 | – Explores the issue of the US national debt and its potential consequences – Offers solutions for fiscal responsibility and economic stability |

| Every Dollar Has a Job: Rule Your Money, Unleash Your Future | 2018 | – Provides an in-depth guide to the “Every Dollar, Every Day” budgeting system – Offers practical tools and resources for managing finances effectively |

| Dave Ramsey’s Complete Guide to Money: The Only Tool You’ll Ever Need | 2019 | – Comprehensive money management guide covering all aspects of personal finance – Includes budgeting, investing, debt reduction, and retirement planning |

FAQs

Q1: How did Dave Ramsey build his wealth after bankruptcy?

A1: He rebuilt through real estate, creating FPU, and leveraging media platforms.

Q2: What’s Ramsey’s biggest income source?

A2: Ramsey Solutions (courses, coaching, and media) generates 70% of his revenue.

Q3: Are the 2025 net worth projections reliable?

A3: Estimates assume steady growth; market shifts or business risks could alter outcomes.

Q4: Does Dave Ramsey invest in stocks?

A4: Yes, primarily in growth stock mutual funds.

Q5: Why does Ramsey oppose credit cards?

A5: He believes they encourage debt, though critics argue rewards can benefit disciplined users.

Dave Ramsey’s Philanthropy

Beyond wealth accumulation, Dave Ramsey is involved in philanthropy.

Through initiatives like Ramsey Solutions’ partnerships with charitable organizations, he demonstrates a commitment to giving back and making a positive impact on communities.

Also Read: Jeff Lerner Net Worth 2024

Conclusion

Dave Ramsey’s net worth in 2025 hinges on his ability to adapt to digital trends and maintain his brand’s trustworthiness. While his strategies face criticism, his impact on personal finance is undeniable.

Whether you follow his advice or not, Ramsey’s journey from bankruptcy to millions offers valuable lessons in resilience and smart money management.