Rivian Stock: Market Capitalization, Dividends, and Growth Projections

Introduction

Rivian, an electric vehicle (EV) manufacturer, is making waves in the automotive industry. In this article, we will delve into the financial aspects of Rivian and explore its stock performance, Rivian stock prediction, market capitalization, dividends, and growth projections. We will also discuss the company’s competitors and its position in the market. So, let’s dive right in!

Rivian Stock Overview

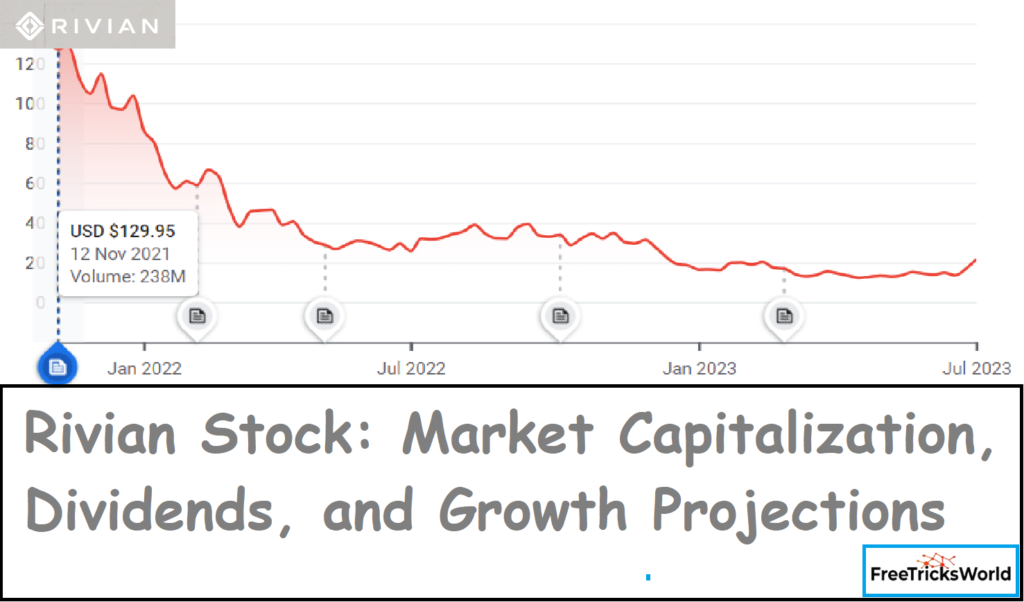

Rivian stock is currently trading at $21.19 per share, with a market capitalization of approximately $19 billion. The company boasts a price-to-earnings (P/E) ratio of 7.5 and a beta value of 0.7, indicating lower volatility compared to the market average. These figures reflect Rivian’s financial standing and investor sentiment towards the company.

Dividends and Financial Ratios

Investors often look for dividends as a way to generate income from their investments. Rivian currently offers a dividend yield of 1.6%, providing shareholders with a modest return. The company maintains a payout ratio of 53%, indicating that 53% of its earnings are distributed as dividends. Additionally, Rivian’s return on equity (ROE) stands at 11.9%, reflecting its ability to generate profits from shareholders’ investments.

Revenue and Net Income

In 2018, Rivian recorded sales of $843.4 million, demonstrating its strong market presence. The company achieved a net income of $1.1 billion in the same year, highlighting its profitability. Looking ahead to 2019, Rivian anticipates a 50% increase in revenue, projecting sales of $1.2 billion. Net income is also expected to grow by approximately 25%, reaching $1.4 billion.

Growth Projections

While Rivian has experienced impressive growth, it’s essential to analyze its future prospects. In 2020, the company’s earnings growth rate is estimated to slow down to 5%, indicating a more stable growth trajectory. However, revenue growth is projected to remain steady at 40%, reflecting continued market demand for Rivian’s products. Furthermore, earnings per share are expected to rise by 10% in 2020, showcasing the company’s commitment to delivering value to its shareholders.

Trading Volume and Market Competition

Rivian’s average daily trading volume stands at approximately 3.5 million shares. This substantial trading activity indicates investor interest and liquidity in the company’s stock. Rivian faces competition from established players in the EV market, including Tesla Motors Inc., BYD Auto Industry Co Ltd, Geely Automobile Holdings Ltd, Daimler AG, BMW Group, General Motors Co., Nissan Motor Co., Renault SA, Volkswagen AG, Volvo Cars, Jaguar Land Rover Plc, Ford Motor Co., Fiat Chrysler Automobiles NV, Honda Motor Co., Mitsubishi Motors Corp., Subaru Corp., Suzuki Motor Corp., and others. The presence of such competitors underscores the fierce competition in the EV industry.

Source: CNN

Conclusion

Rivian’s stock performance, financial ratios, and growth projections position it as an intriguing investment opportunity. With a strong market capitalization, stable dividends, and a promising outlook for revenue growth, Rivian exhibits potential for both short-term and long-term investors. However, it’s important to consider the competitive landscape and monitor the company’s ability to navigate the dynamic EV market. The above data

FAQs (Frequently Asked Questions)

1. Is Rivian a publicly traded company? Yes, Rivian is a publicly traded company with its stock available for trading on the stock market.

2. How does Rivian’s dividend yield compare to its competitors? Rivian’s current dividend yield of 1.6% may vary when compared to its competitors, as dividend policies differ among companies in the EV industry.

3. What factors contribute to Rivian’s market capitalization? Rivian’s market capitalization is determined by multiplying its stock price by the total number of outstanding shares. Factors such as investor sentiment, financial performance, and market demand for EV stocks influence its market capitalization.

4. How does Rivian’s growth rate compare to industry averages? Rivian’s growth rate is subject to industry dynamics and market conditions. While its projected earnings growth rate of 5% in 2020 might be lower than previous years, the company’s revenue growth of 40% showcases its resilience and market positioning.

5. What are the key challenges Rivian faces in the EV market? Rivian faces intense competition from established automakers in the EV market. Staying at the forefront of technological advancements, managing production scalability, and maintaining customer satisfaction are some of the challenges the company needs to address.